oregon tax payment voucher

Checks and payment vouchers for multiple tax programs can be mailed in the same envelope. Enter payment amount Oregon Corporate Activity Tax Payment Voucher Page 1 of 1 Oregon Department of Revenue Use UPPERCASE letters.

Form 40 Fillable Full Year Resident Individual Income Tax Return Form

Use blue or black ink.

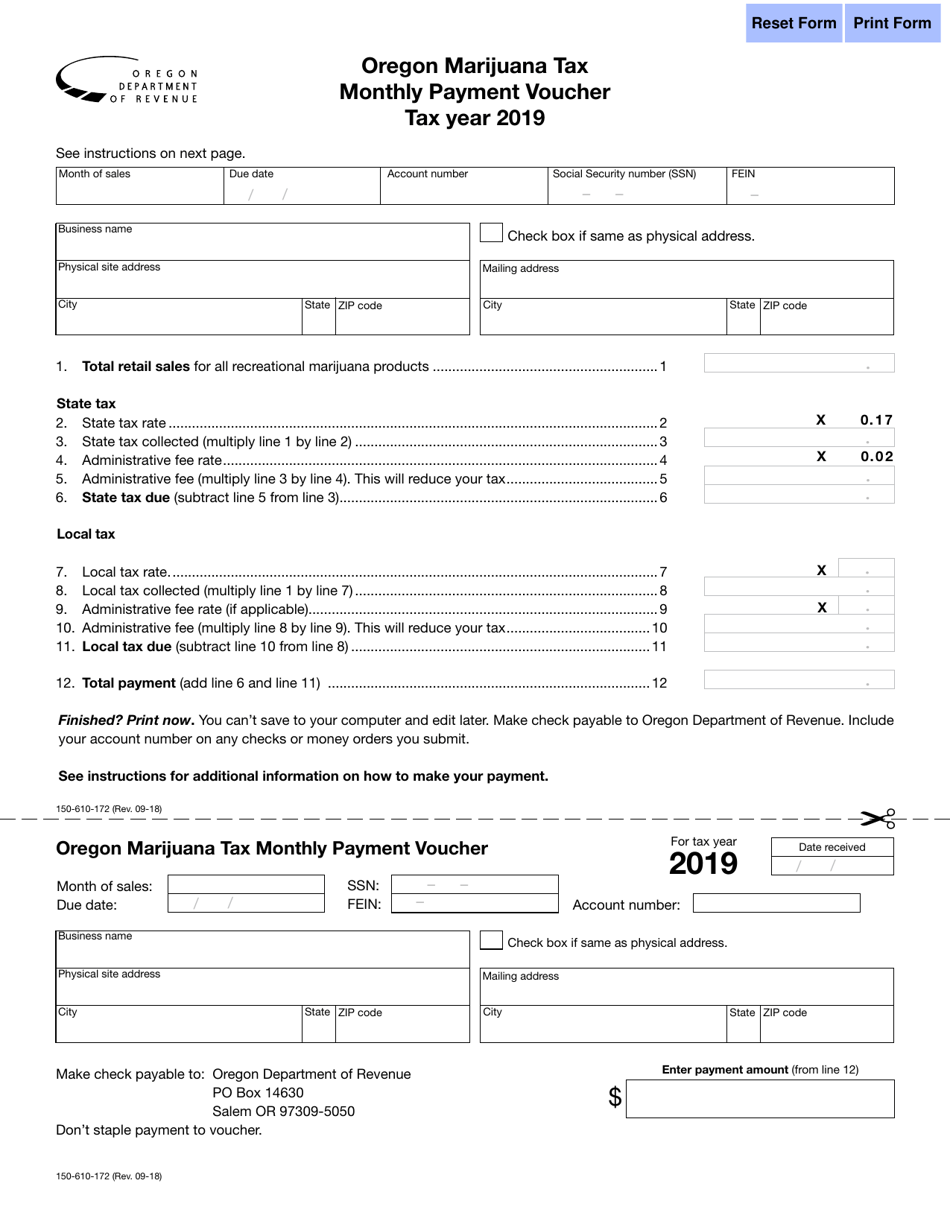

. Print actual size 100. Payment Voucher for Income Tax Voucher. 02 Oregon Marijuana Tax Monthly Payment Voucher and Instructions Payments by mail.

Oregon Department of Revenue Form OR-20-V Oregon Corporation Tax Payment Voucher and Instructions Page 1 of 1 150-102-172 Rev. Dont submit photocopies or use staples. Dont submit photocopies or use staples.

Make your check money order or cashiers check payable to the Oregon Department of Revenue. Oregon Marijuana Tax Oregon Department of Revenue PO Box 14630 Salem OR 97309-5050. Print actual size 100.

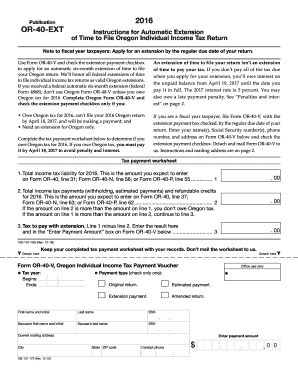

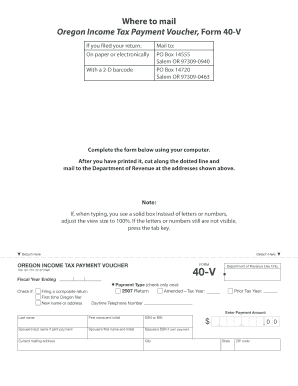

Revenue Division - Personal Income Taxes. Form OR-40-V Oregon Individual Income Tax Payment Voucher 150-101-172. Check one of the payment types that describe your statewide transit tax payment.

Oregon Department of Revenue at httpegovoregongovDOR. Clear form Form OR-40-V Oregon Department of Revenue Oregon Individual Income Tax Payment Voucher Page 1 of 1 Use UPPERCASE letters. Use this voucher only if you are making a payment without a return.

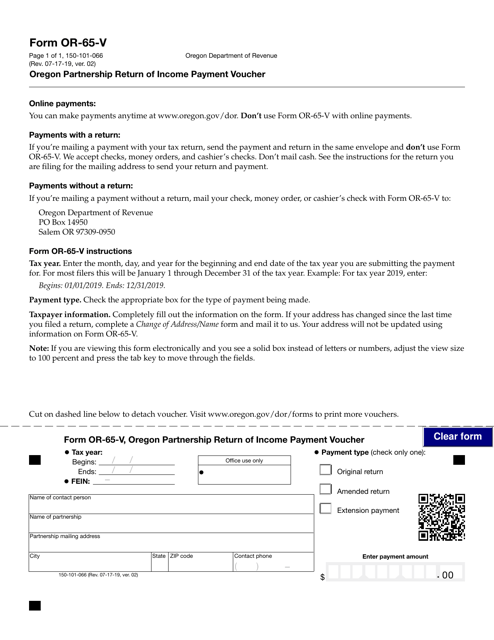

Oregon Marijuana Tax Monthly Payment Voucher Month of sales Page 1 of 1 Oregon Department of Revenue Use UPPERCASE letters. Form OR-DECD-TAX Final Tax and Discharge of a Decedents Estate. Ad Fill Sign Email OR OR-65-V More Fillable Forms Register and Subscribe Now.

Print actual size 100. Form OR-706-V Oregon Estate Transfer Tax Payment Voucher. Form OR-706-V Oregon Estate Transfer Tax Payment Voucher Instructions.

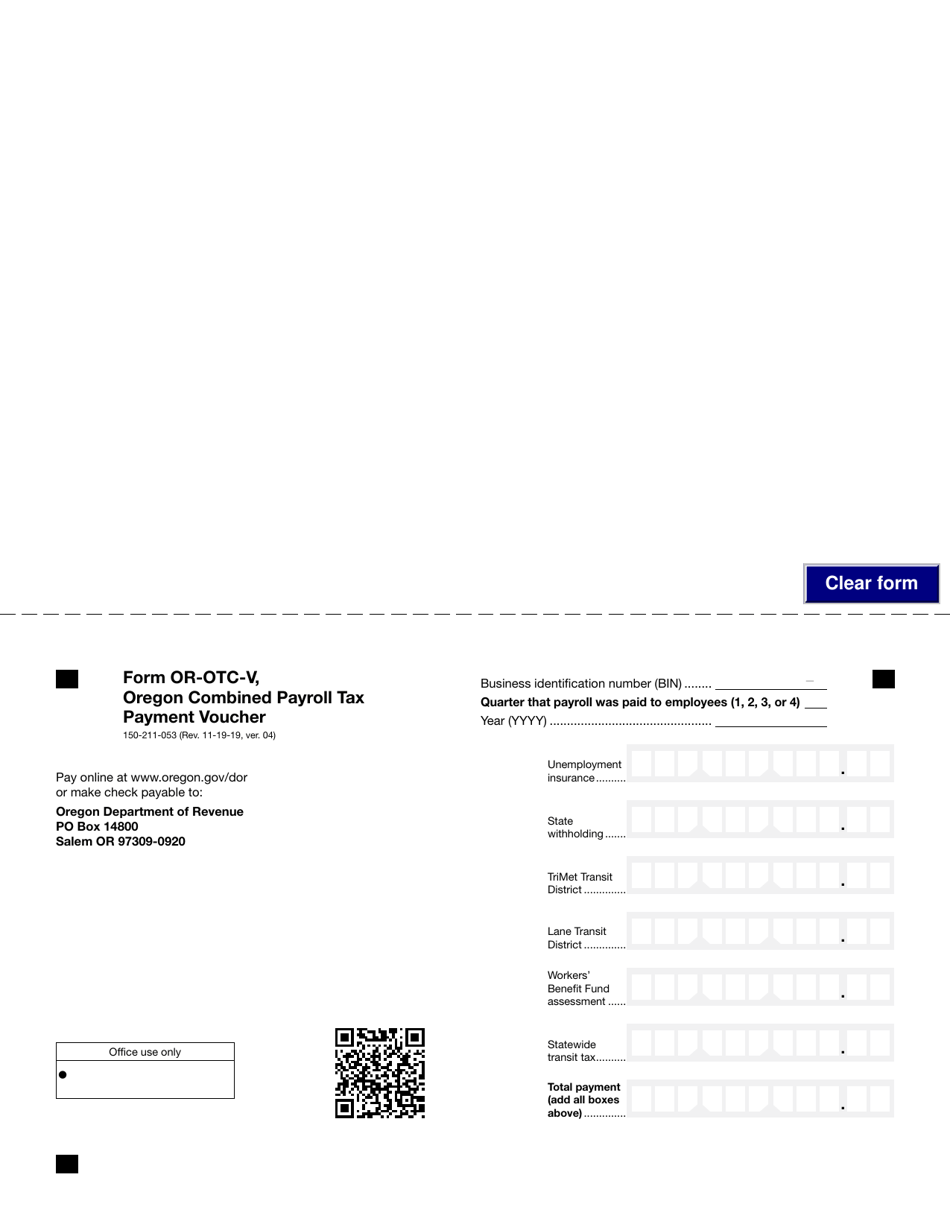

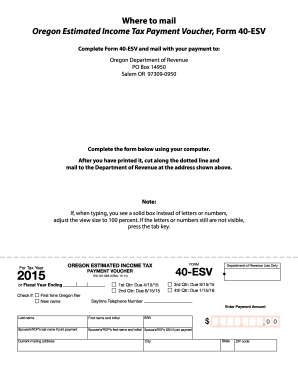

Estimated Income Tax Payment Voucher Estimated. Submit voucher with payment Make check payable to Oregon Department of Revenue. 04 Office use only Business identification number BIN.

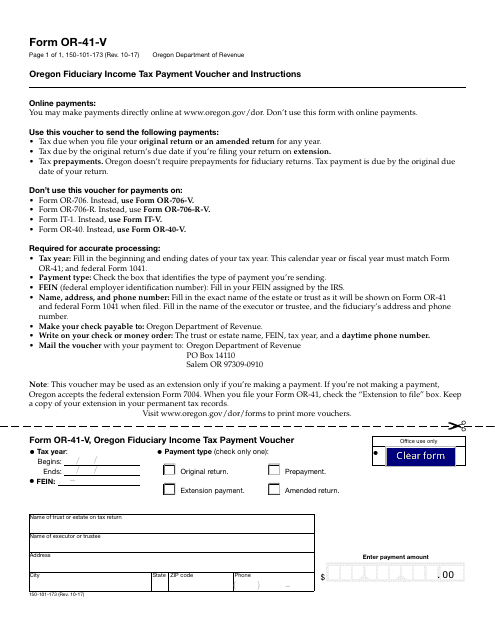

Form 20-V is an Oregon Corporate Income Tax form. Make your check or money order payable to the Oregon. Write Form OR-41-V the trust or estate name the federal employer identification number FEIN the tax year beginning and ending dates and a daytime phone on your payment.

Mail the voucher and payment. Form 40-V is an Oregon Individual Income Tax form. Physical site address City State ZIP code Original return Amended return Estimated payment Payment type check one.

Cash payments must be made at our Salem headquarters located at. Mail your Personal Income Tax Voucher s with your payment s to. Call at least 48 hours in advance 503 945-8050.

Dont submit photocopies or use staples. SSN SSN Current mailing address City State ZIP code Contact phone Enter payment amount Form OR-40-V Oregon Individual Income Tax Payment Voucher Office use only. Enter the month day and year for the beginning and end date of the tax year for this payment.

Enter payment amount LTD Self-employment Tax Payment Voucher Page 1 of 1 Oregon Department of Revenue Use UPPERCASE letters. Learn more about marijuana tax requirements. Ad Download Or Email Form 40-ESV More Fillable Forms Register and Subscribe Now.

Mail check or money order with voucher to. Dont submit photocopies or use staples. Contact name Legal name of filer on tax return Filer address City State ZIP code Contact phone Enter payment amount Form OR-20-V Oregon Corporation Tax.

Use this voucher only if you are making a payment without a return. Resident Individual Income Tax Return Extension. Oregon Department of Revenue PO Box 14800 Salem OR 97309-0920.

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities and are used by the revenue department to record the purpose of the check and the SSNEIN of the taxpayer who sent it. Print actual size 100. Write Form OR-40-V your daytime phone the last four digits of your.

Make your check money order or cashiers check payable to the Oregon Department of Revenue. For more information see Form OR-40-V Instructions. Make your check money order or cashiers check payable to the Oregon Department of Revenue.

Form OR-NRC-CERT Annual Certification for Oregon Natural Resource Credit. Use blue or black ink. Write Form OR-706-V the decedents name the decedents Social Security number DSSN the date of death and a daytime phone for the executor on.

SSN SSN First name and initial Spouses first name and initial Last name Spouses last name Current mailing address City State ZIP code Contact phone Enter payment amount Form OR-40-V Oregon Individual Income. Marijuana Tax Monthly Payment Voucher Form OR-MT-V Oregon Marijuana Tax Monthly Payment Voucher 150-610-172 Form OR-MT-V Oregon Department of Revenue Page 1 of 1 150-610-172 Rev. Oregon Department of Revenue PO Box 14800 Salem OR 97309-0920 Form OR-OTC-V Oregon Combined Payroll Tax Payment Voucher 150-211-053 Rev.

Do not staple payment to voucher. Use blue or black ink. Oregon Department of Revenue PO Box 14950 Salem OR 97309-0950 Form OR-40-V instructions Tax year.

Current mailing address City Contact phone State Last name if filer is an individual ZIP code Social Security. Estimated payment Want to make your payment online. Use blue or black ink.

Make your check money order or cashiers check payable to the Oregon Department of Revenue. Payment type check one Use this voucher only if you are making a payment without a return. Use this voucher only if you are making a payment without a return.

Pay online at wwworegongovdor or make check payable to. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities and are used by the revenue department to record the purpose of the check and the SSNEIN of the taxpayer who sent it. Oregon Department of Revenue Form OR-40-V Oregon Individual Income Tax Payment Voucher and Instructions Page 1 of 1 150-101-172 Rev.

Oregon Individual Income Tax Payment Voucher and Instructions Page 1 of 1 150-101-172 Rev. Mail the completed voucher with payment on or before the payment due date to. Quarter that payroll was paid to employees 1 2 3 or 4.

For most fil-ers this will be January 1 through December 31 of the tax year. Find options at wwworegongovdor. Individual Income Tax Return Instructions for.

Payment without your tax return mail the payment and voucher to. Write Form OR-20-V the filers name federal employer identification number FEIN the tax year beginning and ending dates and a daytime phone on your payment. Designated CAT entity address City Contact phone State Last name ZIP code Social Security number SSN First name Initial.

Oregon Form 40 Esv Estimated Income Tax Payment Voucher 2021 Oregon Taxformfinder

Free Form 40v Payment Voucher For Income Tax Free Legal Forms Laws Com

Oregon Estimated Tax Payment Voucher 2021 Fill Online Printable Fillable Blank Pdffiller

Fillable Online Oregon Form 20 V Oregon Corporation Tax Payment Voucher Oregon Gov Oregon Fax Email Print Pdffiller

Oregon 40 V Payment Voucher Fill Online Printable Fillable Blank Pdffiller

Form 40 Esv Instructions Oregon 40 V Income Tax Payment Voucher 150 101 026 Fill Out And Sign Printable Pdf Template Signnow

Form Or 65 V Download Fillable Pdf Or Fill Online Oregon Partnership Return Of Income Payment Voucher Oregon Templateroller

Form Or Otc V 150 211 053 Download Fillable Pdf Or Fill Online Oregon Combined Payroll Tax Payment Voucher 2019 Templateroller

Form Or 41 V Download Fillable Pdf Or Fill Online Oregon Fiduciary Income Tax Payment Voucher Oregon Templateroller

Get And Sign Oregon Estimated Tax Payment Voucher 2015 2022 Form

Form 150 610 172 Download Fillable Pdf Or Fill Online Oregon Marijuana Tax Monthly Payment Voucher 2019 Templateroller

Oregon 40 V Payment Voucher Fill Online Printable Fillable Blank Pdffiller